Main Body

13 13/ Finance

Adapted from Entrepreneurship. ©2020 Rice University. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution 4.0 International License (CC BY 4.0).

SOURCE: Energepic .

Overview: Entrepreneurial Finance

Learning Objectives

Distinguish between financing and accounting

Describe common financing strategies for different stages of the company lifecycle: personal savings, personal loans, friends and family, crowdfunding, angel investors, venture capitalists, self-sustaining, private equity sales, and initial public offering

Explain debt and equity financing and the advantages and disadvantages of each

The case of iBackPack shows that entrepreneurial success is not guaranteed simply because a company can secure funds. Funds are the capital to get a business, or idea, off the ground. But funding cannot make up for a lack of experience, poor management, or a product with no viable market. Securing funding is one of the first steps for starting a business.

Let us begin by exploring the financial needs and funding considerations for a simple organization. Imagine that you and your college roommate have started your own band. In the past, you have always played in a school band where the school provided the instruments. Thus, you will need to start by purchasing or leasing your own equipment. You and your roommate identify the necessities (guitars, drums, microphones, amplifiers, and so on). In your excitement, you browse for these items online, adding to your shopping cart as you select equipment. You soon realize that even the most basic equipment could cost several thousand dollars. Do you have this much money available to make the purchase right now? Do you have other funding resources, such as loans or credit? Should you consider leasing most or all the instruments and equipment? Would family or friends want to invest in your venture? What are the benefits and risks associated with these funding options?

This same basic inquiry and analysis should be completed as part of every business plan. First, you must determine the basic requirements for starting the business. What kinds of equipment will you need? How much labour and what type of skills? What facilities or locations would you require making this business a reality? Second, how much do these items cost? If you do not possess an amount of money equal to the total expected cost, you will need to determine how to fund the excess amount.

Once a new business plan has been developed or a potential acquisition has been identified, it is time to think about financing, which is raising money for an intended purpose. Here, the purpose is to launch a new business. Typically, those who can provide financing want to be assured that they could, at least potentially, be repaid in a short period, which requires a way that investors and business owners can communicate how that financing would happen. This brings us to accounting, which is the system business owners used to summarize, manage, and communicate a business’s financial operations and performance. The output of accounting comprises financial statements, discussed in Accounting Basics for Entrepreneurs. Accounting provides a common language that allows business owners to understand and decide about their venture that are based on financial data, and enables investors looking at multiple investment options to make easier comparisons and investment decisions.

Entrepreneurial Funding across the Company Lifecycle

An entrepreneur may pursue one or more different funding. Identifying the lifecycle stage of the business venture can help entrepreneurs decide which funding opportunities are most appropriate for their situation.

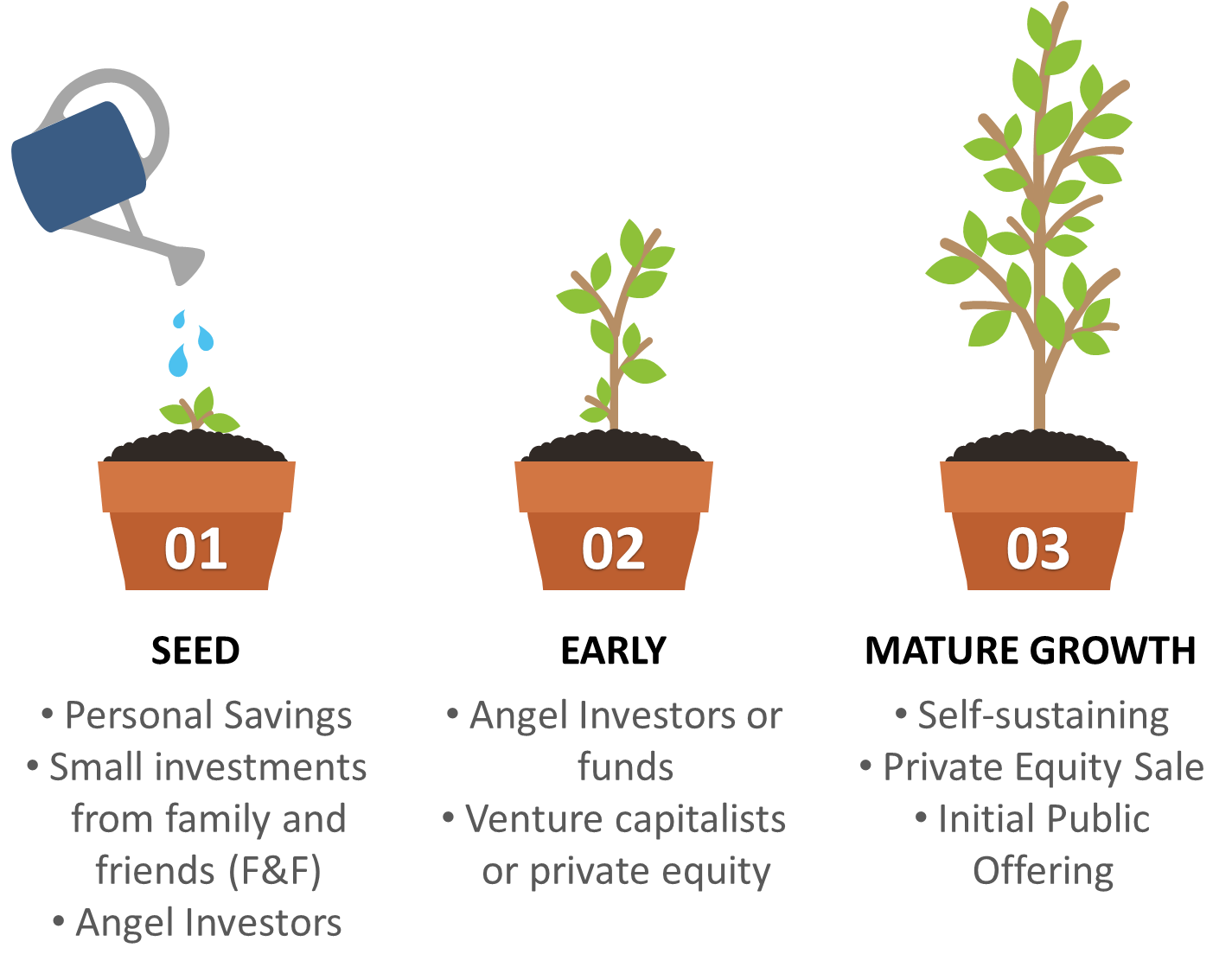

From inception through successful operations, a business’s funding grows generally through three stages: seed stage, early-stage, and maturity (see Figure below). A seed stage company is the earliest point in its lifecycle. It is based on a founder’s idea for a new product or service. Nurtured correctly, it will eventually grow into an operational business, much as an acorn can grow into a mighty oak, hence the name “seed” stage. Typically, ventures at this stage are not yet generating revenue, and the founders have not yet converted their idea into a saleable product. The personal savings of the founder, plus perhaps a few small investments from family members, usually make up the initial funding of companies at the seed stage. Before an outsider invests in a business, they will typically expect an entrepreneur to have exhausted F&F financing (friends and family financing) to reduce risk and instill confidence in the business’s potential success.

After investments from close personal sources, the business idea may build traction and attract the attention of an angel investor. Angel investors are wealthy, private individuals seeking investment options with a greater potential return than is traditionally expected on publicly traded stocks, albeit with much greater risk. For that reason, they must be investors accredited by the federal Securities and Exchange Commission (SEC) and they must meet a net worth or income test. Nonaccredited investors are allowed in certain limited circumstances to invest in security-based crowdfunding for startup companies. Among the investment opportunities angel investors look at are startup and early-stage companies. Angel investors and funds have boomed in the past ten years, and angel groups exist in every state.

Figure 1. Business Funding Stages

An early–stage company has begun development of its product. It may be a technical proof of concept that still requires adjustments before it is customer ready. It may also be a first-generation model of the product that is securing some sales but requires modifications for large-scale production and manufacturing. At this stage, the company’s investors may now include a few outsider investors, including venture capitalists.

A venture capitalist is an individual or investment firm that specializes in funding early-stage companies. Venture capitalists differ from angel investors in two ways. First, a venture capital firm typically operates as a full-time active investment business, whereas an angel investor may be a retired executive or business owner with significant savings to invest. Venture capital firms operate at a higher level of sophistication, often specializing in certain industries and with the ability to leverage industry expertise to invest with more knowledge. Typically, venture capitalists will invest higher amounts than angel investors, although this trend may shift as larger angel groups and “super angels” invest in venture rounds.

Private equity investment is a rapidly growing sector and generally invests later than venture capitalists. Private equity investors either take a public company private or invest in private companies (hence the term “private equity”). The ultimate goals of private equity investors are generally taking a private company public through an initial public offering (IPO) or by adding debt or equity to the company’s balance sheet and helping it improve sales and/or profits to sell it to a larger company in its sector.

Companies in the mature stage have reached commercial viability. They are operating in the manner described in the business plan: providing value to customers, generating sales, and collecting customer payments in a timely manner. Companies at this stage should be self-sufficient, requiring little to no outside investment to maintain current operations. For a product company, this means manufacturing a product at scale, in enormous volumes. For a software company or app provider, this means generating sales of the software or subscriptions under a SaaS model (Software as a Service) and possibly securing advertising revenue from access to the user base.

Companies at the mature stage have different financing needs from those in the previous two stages, where the focus was on building the product and creating a sales/manufacturing infrastructure. Mature companies have reached a consistent level of sales but may seek to expand into new markets or regions. Typically, this requires significant investment because the proposed expansion can often mirror the present level of operations. An expansion at this level may cause doubling the size of the business. To access this amount of capital, mature companies may consider selling a portion of the company, either to a private equity group or through an IPO.

An initial public offering (IPO) occurs when a first-time company offers ownership shares for sale on a public stock exchange, such as the New York Stock Exchange. Before a company executes an IPO, it is privately held, usually by its founders and other private investors. Once the shares are available to the public through a stock exchange, the company is considered being publicly held. This process typically involves an investment banking firm that will guide the company. Investment bankers will solicit institutional investors, such as State Street or Goldman Sachs, which will sell those shares to individual investors. The investment banking firm typically takes a percentage of the funds raised as its fee. Benefits with an IPO is that the company gains access to a massive audience of potential investors, but the downside is owners giving up more ownership in the business and subject to many costly regulatory requirements. The IPO process is highly regulated by the SEC, which requires companies to provide comprehensive information upfront to potential investors before completing the IPO. These publicly traded companies must also publish quarterly financial statements, which are required to be audited by an independent accounting firm. If the company does not meet investors’ expectations, the value of the company can decline, further hindering its future growth options.

A business’s lifecycle stage influences its funding strategies and so does its industry. Different industries have varying financing needs and opportunities. For example, if you were interested in opening a pizzeria, you would need a physical location, pizza ovens, and furniture so customers could dine there. These requirements translate into monthly rent on a restaurant location and the purchase of physical assets (i.e. ovens and furniture). This type of business requires a higher investment in physical equipment than a service business, such as a website development firm. A website developer could work from home and potentially begin a business with minor investment in physical resources, but with a significant investment of their own time. Essentially, the web developer’s initial funding requirement would simply be several months’ worth of living expenses until the business is self-sufficient.

Once we understand where a business is in its lifecycle and which industry it operates in, we can get a sense of its funding requirements. Business owners can gain funding through different avenues, each with its own advantages and disadvantages (see Special Funding Strategies).

Types of Financing

Although many types of individuals and organizations can provide funds to a business, these funds typically fall into two categories: debt and equity financing (see Table below). Entrepreneurs should consider the advantages and disadvantages of each type as they determine which sources to pursue to support their venture’s immediate and long-term goals.

Table 1. Debt vs. Equity Financing

|

|

Debt Financing |

Equity Financing |

|

Ownership |

Lender does not own stake in company |

Lender owns stake in company |

|

Cash |

Requires early and regular cash outflow |

No immediate cash outflow |

Debt Financing

Debt financing is borrowing funds from another party. Ultimately, this money must be repaid to the lender, usually with interest (the fee for borrowing someone else’s money). Debt financing may be secured from many sources: banks, credit cards, or family and friends, to name a few. The maturity date of the debt (when it must be repaid in full), the payment amounts and schedule over the period from securement to maturity, and the interest rate can vary widely among loans and sources. You should weigh all these elements when considering financing.

The advantage of debt financing is that the debtor pays back a specific amount. When repaid, the creditor releases all claims to its ownership in the business. The disadvantage is that repayment of the loan typically begins immediately or after a short grace period, so the startup faces a quick cash outflow requirement, which can be challenging.

One source of debt financing for entrepreneurs is the Small Business Administration (SBA), a government agency founded as part of the Small Business Act of 1963, whose mission is to “aid, counsel, assist and protect, where possible, the interests of small business concerns.”178 The SBA partners with lending institutions such as banks and credit unions to guarantee loans for small businesses. The SBA typically guarantees up to 85% of the amount loaned. Whereas banks are traditionally wary of lending to new businesses because they are unproven, the SBA guarantee takes on some of the risk that the bank would normally be exposed to, providing more incentive to the lending institution to finance an entrepreneurial venture.

To illustrate an SBA loan, let us consider the 7(a) Small Loan program. Loans backed by the SBA typically fall into one of two categories: working capital and fixed assets. Working capital is simply the funds a business has available for day-to-day operations. If a business has only enough money to pay bills that are currently due, that means it has no working capital, a precarious position for a business to be in. A business in this position may want to secure a loan to help see it through leaner times. Fixed assets are major purchases like land, buildings, equipment, and so on. The amounts required for fixed assets would be significantly higher than a working capital loan, which might cover just a few months’ expenses. As we will see, loan requirements made under the 7(a) Small Loan program are based on loan amounts.

For loans over $25,000, the SBA requires lenders to demand collateral. Collateral is value that a business owner pledges to secure a loan, meaning that the bank has something to take if the owner cannot repay the loan. Thus, in approving a larger loan, a bank might ask you to offer your home or other investments to secure the loan. In a real estate loan, the property you are buying is the collateral. Loans for larger purchases can be less risky for a bank, but this can vary widely from property to property. A loan that does not require collateral is referred to as unsecured.

SOURCE: Anthony Shkraba.

To see how a business owner might use an SBA loan, let us return to the example of a pizzeria. Not all businesses own the buildings where they operate; in fact, many businesses simply rent their space from a landlord. Here, a smaller loan would be needed than if the business owner were buying a building. If the prospective pizzeria owner could identify a location available for rent that had been a restaurant, they might need only to make superficial improvements before opening to customers. This is a case where the smaller, collateral-free type of SBA loan would make sense. Some funds would be allocated for improvements, such as fresh paint, furniture, and signage. The rest could pay employees or rent until the pizzeria has sufficient customer sales to cover costs.

Besides smaller loans, this SBA program also allows for loans up to $350,000. Above the $25,000 threshold, the lending bank must follow its own established collateral procedures. It can be difficult for a new business to provide collateral for a larger loan if it does not have significant assets to secure the loan. For this reason, many SBA loans include the purchase of real estate. Real estate can be accepted as collateral because it cannot move and holds it value yearly. For the pizzeria, an aspiring business owner could take advantage of this higher level of lending when the business is buying the property where the pizzeria will be. Here, most loan proceeds will probably go toward the purchase price of the property. Both the high and low tiers of the SBA loan program are examples of debt financing. In Special Funding Strategies, we will look at how debt financing differs from equity financing.

Equity Financing

In terms of investment opportunities, equity investments are those that involve purchasing an ownership stake in a company, usually through shares of stock in a corporation. Unlike debts that will be repaid and thus provide closure to the investment, equity financing is financing provided in exchange for part ownership in the business. Like debt financing, equity financing can come from unique sources, including friends and family, or more sophisticated investors. You may have seen this type of financing on the TV show Shark Tank. Contestants on the series pitch a new business idea to raise money to start or expand their business. If the “sharks” (investors) want to invest in the idea, they will make an offer for an ownership stake. For example, they might offer to give the entrepreneur $200,000 for a return of 40% ownership of the business.

The advantage of equity financing is that there is no immediate cash flow requirement to repay the funds, as there is with debt financing. The drawback of equity financing is that the investor in our example is entitled to 40% of the profits for all future years unless the business owner repurchases the ownership interest, typically at a much higher valuation, an estimate of worth, usually described in relation to the price an investor would pay to acquire the entire company.

This is illustrated in the real-life example of the ride-sharing company Uber. An early investor in the company was Benchmark Capital, with an initial investment of $12 million in Uber in exchange for stock. That stock, as of its IPO date in May 2019, was valued at over $6 billion, which is the price that the founders would have to pay to get Benchmark’s share back.

Some financing sources are neither debt nor equity, such as gifts from family members, funds from crowdfunding websites such as Kickstarter, and grants from governments, trusts, or individuals. The advantages and disadvantages of these sources are discussed in Special Funding Strategies.

Special Funding Strategies

SOURCE: Matthias Zomer.

Learning Objectives

Identify funding strategies used by charitable organizations

Describe financing opportunities available to startups

Define bootstrapping

Describe the advantages and disadvantages of bootstrapping

It is important to recognize that not all startups are Silicon Valley tech companies. These companies create high-profile products, such as applications and websites, which can take years to become profitable or even generate revenue. Much more common are the small businesses founded every day by entrepreneurs seeking to create value in their local communities. Not all startups are founded with a profit motive in mind.

Charitable organizations, or certain non-profit companies, are often founded for altruistic purposes, such as advancing the arts, education, and science; protecting the natural environment; providing disaster relief; and defending human rights (see Table below).

Table 2. Charitable Missions and Example Organizations

|

Mission |

Examples |

|

Advance education |

Teach for America, Khan Academy |

|

Protect the natural environment |

Sierra Club, Wildlife Conservation Society |

|

Defend human rights |

Amnesty International, Human Rights Watch |

|

Provide disaster relief |

American Red Cross |

|

Support the arts |

Metropolitan Museum of Art, Americans for the Arts |

These goals supersede the profit motive that a traditional company would have. As a result, the funding strategies of these enterprises often differ dramatically from those of standard for-profit businesses. Without the emphasis on profit, it’s difficult to provide for the cost of ongoing operations. Thus, these organizations must develop a sustainable strategy, one that can maintain the organization’s financial stability.

In the United States, such organizations can qualify for tax-exempt status, meaning that if there is a profit from operations, it is not typically subject to taxes. Organizations seeking this exemption must apply to the Internal Revenue Service for tax-exempt status and provide information about what kind of mission the organization carries out (charitable, scientific, educational, and so on).

Consider a museum. What is its purpose? Traditional companies provide a product or service to their customers for payment and typically fill a need their customers have. A grocery store sells food because human beings need to eat food to survive. Although viewing paintings and sculptures is not a physical requirement for life, this experience arguably enriches our lives and helps educate and shape our society. That is why museums are founded. Consider the original mission statement of the Metropolitan Museum of Art (commonly known as the “Met”) in New York City (see Figure below).179

Figure 2. NYMMA Mission Statement

SOURCE: The mission statement of New York’s Metropolitan Museum of Art. (attribution: Copyright Rice University, OpenStax, under CC BY 4.0 license).

This is a different goal than most small businesses (providing a product or service for a profit) and, as a result, requires different financing strategies, such as a combination of program services, donations, and grants.

Go to the Internal Revenue Service’s website and look at the most recently updated Pub 334 Tax Guide for Small Business to learn more about the rules for income tax preparation for a small business.

Go to the Internal Revenue Service’s website and look at the most recently updated Pub 334 Tax Guide for Small Business to learn more about the rules for income tax preparation for a small business.

Program Services

Program services are the basic offerings that a non-profit organization provides that result in revenue, although not typically enough to cover the overall cost of running the organization. These services most closely resemble the customer interactions of a traditional business. The organization provides a product or service for a customer’s money.

In our museum example, program services could take a few different forms. First, the museum likely charges a fee for admission to view the artwork and artifacts. The individual ticket price multiplied by the number of museum visitors equals the museum’s ticket revenue. An established museum will have a sense of how many visitors it has on average and create a budget accordingly.

Another source of program service revenue for a museum could take the form of hands-on educational activities or events with guest speakers or presenters. Often museums will host local artists, or their own employees might conduct art classes or special-topic tours. These events and activities typically have a charge (revenue) beyond the regular admission cost.

Despite these revenue-generating activities, non-profit organizations still face many funding challenges in covering all the operating costs of a normal business, such as employee wages, facility costs, and advertising. Thus, they need many sources of income. To illustrate, the Met’s 2018 program service income only made up 2.3% of its total revenue for the year.180

Donations

One benefit to a business with a charitable mission is inherent public support, which can foster community involvement above and beyond patronage. For non-profits, this can translate into a willingness to donate money to the organization. A donation is a financial gift with no expectation of repayment or receiving anything in return. A traditional business must provide something valuable to create a customer exchange: Their customers demand value for their hard-earned money.

The benefactors of a charitable organization want to help further the mission of the organization. This type of entity (whether it is a museum, a hospital, or the Red Cross) relies on the goodwill of community supporters. For the Met, with a low percentage of revenue generated by program services, donations, and charitable gifts are vital to the organization’s financial viability.

Grants

Another source of funding for non-profit organizations is grants. A grant is a financial gift given for a specific purpose by a government agency or a charitable organization such as the Bill and Melinda Gates Foundation. Like a donation, a grant does not have to be repaid. Unlike with donations, both non-profit and for-profit organizations can compete for grants. Whereas donations are typically given without restriction to offset the general operating expenses of the organization, grants often specify how the funds are to be used. Most grant-providing entities have an agenda or purpose behind their funding. For example, the National Institutes of Health (NIH) provides grants “to support the advancement of the NIH mission to enhance health, extend healthy lives, and reduce the burdens of illness and disability.”181 This federal organization invests over $32 billion annually for medical research.

Grants can be very competitive, requiring a rigorous application process. Usually, multiple organizations apply for the same grant; the organization issuing the grant reviews the many competing applications to make its selection. Grantees generally must submit audited financial statements and are required to update the grantor after the grant award to ensure proper intended use. The NIH awards almost 50,000 grants annually, most of which are competitive. Although that is an enormous number of projects to fund, only 20% of applications submitted to the NIH in 2018 were accepted.182 The NIH rejected four out of every five applications. For entrepreneurs, this means that when you identify a grant that is specific to your organization’s mission, weigh your chances of being awarded the grant when considering it as part of your funding strategy.

To understand grants let us further examine the NIH. The NIH Small Grant Program provides funds for activities such as the development of new research technology. This specific grant can be awarded for up to a two-year period, with funds of up to $50,000 in direct costs per year. A grant like this could provide vital support to a non-profit startup.

Some business ventures fall somewhere between organizations completely committed to charitable work and traditional small businesses with entrepreneurs focused on social entrepreneurship. Social entrepreneurs develop products and services as solutions to societal problems. For example, the TOMS shoe company could create a business model through which the company gives one pair of shoes to children in need in foreign countries for every pair of shoes purchased, known as “One for One.”183

The company’s website describes the origins of both the company and this model, which are based on the experiences of its founder, Blake Mycoskie (see Figure below).184

SOURCE: The TOMS origin story provides an example of social entrepreneurship. (attribution: Copyright Rice University, OpenStax, under CC BY 4.0 license)

Social entrepreneurship offers the ability to effect positive change in the world without simply relying on donations. It pairs a profitable, sustainable business model with a good cause. This combination often creates positive word-of-mouth. It gives potential customers a good feeling about the product beyond just its style or function.

What Can You Do? Social Entrepreneurship

Like the founder of TOMS, sometimes in our everyday life, we are presented with an opportunity to help people. We may even find out that we are not alone in this desire to help. What opportunities to help (individuals, society, or environment) do you see in your own community? What are some ways that you could raise awareness around this issue?

No-Loan Finance Strategies

As you have learned, many startups come into being through the extensive use of debt. Although borrowing is a legitimate source of funding, it can be risky, especially if the entrepreneur is personally responsible for repayment. Some entrepreneurs max out credit cards, take out home-equity loans against their primary residences, or secure other high-interest personal loans. If the entrepreneur cannot repay the loans, the result can be repossession of equipment, home foreclosure, and other legal action.

We now examine funding strategies attractive to many startups that do not require going into debt or exchanging ownership of the business for financial support (debt and equity financing). The financing methods described here are more creative funding strategies, including crowdfunding, bartering, and other methods.

SOURCE: Ryutaro.

Crowdfunding

Recall the story of iBackPack. This venture was originally funded by contributions through Indiegogo and Kickstarter. These websites are a form of crowdfunding, which involves collecting small sums of money from many people. The people who contribute money are typically referred to as backers because they are backing the project or supporting the business idea.

Browsing these crowdfunding websites, you will see many kinds of ventures seeking financial backing, from creating new board games to opening donut cafes. Each project identifies an overall specific funding goal in terms of a dollar amount. Some crowdfunding websites, such as Kickstarter, implement an “all or nothing” model in which projects do not receive any funds unless their overall funding goal is met. The amount can be exceeded, but if it is not met, the project receives nothing. For an entrepreneur using this resource, selecting an attainable funding goal must be a core part of their strategy. The funding goal must also be appropriate to the scale of the project. For example, setting a goal of $50,000 may be reasonable for launching a food truck (which could be a prototype for a full restaurant), but it is a mere fraction of the cost of constructing an entire table-service restaurant, which would come closer to $750,000. An entrepreneur entering the culinary world should consider which target would be most achievable as well as most beneficial in meeting both short- and long-term goals. Also, remember that meeting the funding goal does not ensure success of the business, as with iBackPack.

Entrepreneurs vying for crowdfunding usually employ some common tactics. First, they often post an introductory video that explains the project goal and the specific value proposition (i.e. a chef might seek $75,000 to open a food truck specializing in a relatively unknown cuisine). Second, the entrepreneur provides a more detailed written summary of the project, often including specific items that the funding will pay for, such as $50,000 for a vehicle, $10,000 for graphic design and vehicle decals, and $15,000 for kitchen equipment for the truck. Last is the reward structure, which is what entices visitors to the site to fund the project, offering a return beyond their own passion for the venture. The reward structure establishes different levels of funding and ties a specific reward to each level. For example, for a contribution of $5, the chef might thank the backer on social media; for $25, the backer would get a t-shirt and a hat featuring the food truck’s logo; for $100, the backer would get five free meals when the food truck opens. Fees for these crowdfunding sites vary from 5% to 8%. Kickstarter now requires physical products or prototypes for some startups, as well as a short video to help represent and “sell” the product.

Although this financing source offers a lot of flexibility, businesses using crowdfunding can run into trouble. Certain funding levels and rewards may have limits. For example, a reward structure might offer backers contributing $1,000 a trip to the grand opening of the food truck, including airfare and hotel. These top-tier rewards can generate a lot of excitement, but the expense of flying people around the country and providing accommodations could become unmanageable. One research study stated that 84% of Kickstarter’s top projects delivered their rewards late.185

The advantage of crowdfunding is that the business receives cash up-front to launch. The downside is that the reward requires a future payment to the backers. This payment may be as branded merchandise, meals, or even events or travel, so it is important for entrepreneurs to set aside part of the investment money to fund the rewards. Depending solely on generating the reward funds out of future sales is a risk that might cause upsetting the fans who made the business possible. Since crowdfunding is managed online, another risk is upsetting the project’s vocal supporters. Crowdfunding usually provides only a “kick start” for a startup, most seed stage companies need additional funding from other sources for their first commercial launch.

Although social media can backfire, entrepreneurs can take advantage of benefits too. Crowdfunding can allow an entrepreneur to build a community around a product before it is even sold. Like-minded fans of a product can connect with each other over the internet, in the feedback section of a website, or in shared social media posts. Backers of a project can become cheerleaders for it by sharing the idea (and their enthusiasm for it) with friends, family, and coworkers. Word-of-mouth marketing can lead to more backers or future customers after launch.

Dozens of crowdfunding portals exist, including WeFunder, SeedInvest, Kickstarter, and Crowdcube. Current SEC guidelines186 for issuing and investing limits granted for Title III Crowdfunding include:

A company can raise up to $1 million in aggregate through crowdfunding offerings over a 12-month period.

Over a 12-month period, individual investors can invest in the aggregate across all crowdfunding offerings up to:

$2,000 or 5% of the unaccredited investors net worth or yearly income if they make less than $100,000/year.

10% of the lesser of their annual income or net worth, if both their annual income and net worth are equal to or more than $100,000.

Kickstarter

Visit the Kickstarter website at https://www.kickstarter.com/ and review a few projects. What did they do well in the video pitch? What unique rewards did they offer? How would you implement a Kickstarter page for your own business idea?

Visit the Kickstarter website at https://www.kickstarter.com/ and review a few projects. What did they do well in the video pitch? What unique rewards did they offer? How would you implement a Kickstarter page for your own business idea?

Bartering

Startup companies rarely have a lot of cash assets on hand to spend, but they often have offerings that can provide value to other businesses. Bartering is a system of exchanging goods or services for other goods or services instead of for money. Let us consider the case of Shanti, a website designer who wants to start a business. She may want to have her business formally incorporated or may require other legal help, such as review of standard contracts. Hiring a lawyer outright for these services can be costly, but what if the lawyer needed something the website designer could provide?

Whether the lawyer has just started his own business or has been established for several years, he may need a website created or have an old website redesigned and updated. This website overhaul could prove costly for the lawyer. But what if there were a way that both the lawyer and the web designer could get what they wanted with a resulting net cost of zero dollars? Bartering can achieve this. It should be noted there are accounting and tax implications involved with bartering that can prevent a net zero offset of costs.

In a barter scenario, Shanti could create a website for the lawyer at the expense only of her time, which in the startup phase is often more abundant than actual cash. The lawyer could provide incorporation services or contract review in exchange, requiring no cash outlay. For many entrepreneurs, this type of exchange is appealing and enables them to meet business needs at a lower perceived cost. Although more mature firms can also use bartering, the opportunity cost is much higher. If a mature company cannot take on a new paying client because it is doing too much free (barter) work, it may lose out on future revenue, which might be a big loss. Startups, in contrast, often have excess capacity while they develop a customer base, so taking on barter work is often a low-risk, beneficial funding strategy.

Other No-Loan Funding Options

Beyond crowdfunding and bartering, startups have other options to help them get off the ground, such as funding competitions and pre-orders (see Figure below). Many organizations hold entrepreneurial finance contests provide financial awards to the winners. These prize funds can seed money to start a new venture. For example, the New York City Public Library holds an annual business plan competition called the New York StartUP! Business Plan Competition.187 Applicants must complete an orientation session, attend workshops that develop skills related to the creation of a business plan, and submit a complete business plan. The first-place award yields $15,000 in prize money, which can be a splendid start toward turning an entrepreneurial idea into a business reality.

Another way for startups to gain financial traction is to solicit pre-orders. Consider the launch of a new book or video game. Retail stores will often solicit pre-orders, which are advance purchases of the product. Customers pay for the desired item before they even have access. For example, the entrepreneur Mitchell Harper raised $248,000 in funds before his product launched.188 This approach is not limited to existing, well-known franchises, startups can use it as well. Although established novel and video game franchises have large fan bases and often large advertising budgets, startups can still find effective strategies in this space.

Figure 4. No-loan Funding Options

SOURCE: Entrepreneurs can explore a variety of no-loan funding options. (attribution: Copyright Rice University, OpenStax, under CC BY 4.0 license)

Companies with a prototype model of their product or a first manufacturing run can showcase the new product to potential customers, who may be interested enough to place an order. The company can use the funds received from these pre-orders to pay for the inventory. Besides having sales staff make sales calls, new companies can attend trade shows and exhibitions to garner interest in the product. Many new products are launched in this fashion because it allows access to many potential customers in one place.

Why Bootstrapping Hurts, Then Helps

The process of self-funding a company is typically referred to as bootstrapping, based on the adage that urges us to “pull ourselves up by our bootstraps.” It describes a funding strategy that seeks to optimize use of personal funds and other creative strategies (such as bartering) to minimize cash outflows. In recent years, this strategy has been the fodder for shows like Shark Tank. These shows may make entrepreneurs think that being on TV is glamorous, or the shows may glorify the financial backing of millionaires and billionaires. We have seen that for many entrepreneurs there are drawbacks to bringing in outside investors to launch your venture. These drawbacks include loss of future profits and control of the company, among others. Potential business owners must weigh the advantages and disadvantages (both short- and long-term) for funding their specific dream.

You have learned about financing strategies predicated on finding a willing investor or lender, but many small businesses simply do not have access to large amounts, or any amount, of capital. In these cases, aspiring business owners need lean business strategies that will yield the greatest benefit.

SOURCE: Fauxels.

Bootstrapping requires entrepreneurs to shed any preconceived notions of the popular-culture image of startups. Most startups do not have trendy downtown offices, foosball tables, or personal chefs. Bootstrapping reality looks more like late nights spent clipping coupons. It involves scrutinizing potential expenses and whether each cost is worth the investment. It can be a difficult and trying to process, but with no angel investors or wealthy family backers, bootstrapping is often an entrepreneur’s only option. The good news is that this approach can pay substantial dividends in the long run.

The Basics of Bootstrapping

When entrepreneurs risk their life savings, they must stretch every dollar as far as possible. Having a limited amount of capital to work with requires optimizing creative strategies to get the business launched and keep it afloat. This creativity applies to bringing customers and sales in the door and to managing expenses.

Understanding the ongoing costs of the business is key. In an interview on NPR’s show How I Built This, Barbara Corcoran, one investor on Shark Tank, shares her humble beginnings in real estate brokerage.189 One of things she touches on is being constantly aware of how long her money would last, given her monthly expenses. If she had $10,000 in the bank and the cost of her rent and employees was $2,500 per month, she knew that the money would last her four months. Such constant information and vigilance are required when bootstrapping a business for success.

Employee costs are typically one of the largest expenses facing a business. Hiring traditional full-time employees can be costly; onboarding them too early can be fatal to a business’s bottom line. Creative approaches to minimizing labour costs can be enormously helpful. One strategy for controlling these costs is using independent contractors (freelancers) and other part-time employees. They do not work full-time for the business and may serve other companies as well. Their compensation is generally lower than that of a full-time, salaried employee, often in part because these positions rarely come with any benefits, such as health insurance or paid time off. Using these workers to fill resource needs can help minimize costs. Once operations have stabilized, it may be possible and ideal to offer full-time employment to these individuals.

Marketing is another key area for new business investment, but billboards, web ads, TV ads, and radio spots can be expensive. TV and radio ads can also be ineffective if they are aired during low-volume times, which is typically all that startups with lower budgets can afford. Fortunately, there are many low- or no cost marking opportunities, such as word-of-mouth marketing. Doing a good job for one customer can easily lead to referrals for more business. Some social media efforts can also provide a strong return for minimal investment, although typically it is nearly impossible to gauge an effort’s potential impact or success.

A new enterprise that is bootstrapping must also carefully manage operational expenses. At the beginning of operations, an entrepreneur can often minimize unnecessary expenses, even if that means forgoing an actual business location. Working out of a home office or a co-working space (such as WeWork or Impact Hub) can lead to significant savings. Renting office space can cost hundreds or thousands of dollars a month, whereas a home office typically requires no additional investment. Depending on the location, co-working spaces can provide a single workspace and technology access for as little as $50 to $100 per month, yielding substantial savings over a dedicated office suite. In larger cities, or in locations with more amenities, the monthly costs can run between $100 and $500 per month.

The Boston Beer Company, which today produces the Samuel Adams line of beers, provides a classic example of minimizing these costs in its early days. When this company first started, it owned no office space, or even a brewery. It employed other breweries as contract brewers to manufacture its beer. Its founder, Jim Koch, invested most of his time in selling to bars and restaurants, working from his car and phone booths (This was during the 1980s). His lean strategy was a successful application of the bootstrapping mindset. From its humble beginnings, the Boston Beer Company has become one of the largest American-owned breweries, ranked second based on 2018 sales volume by the Brewers Association.190 Whereas traditional thinking may dictate that a company must have an official office or headquarters, a bootstrapping mindset evaluates what the space would be used for and the trade-offs for its cost.

How Bootstrapping Hurts

Bootstrapping is not easy and fraught with tight budgeting and sacrifice, which can take its toll on an entrepreneur. One of the simplest bootstrapping strategies is to start a business by moonlighting or treating your business venture as a second job. Employing this strategy, the entrepreneur continues to work at their regular job, say from 9:00 a.m. to 5:00 p.m. and then dedicates the rest of the evening and weekends to working on the business. Whereas this strategy has the obvious benefit of maintaining a comfortable level of income, this approach has a few drawbacks (see Table below). Moonlighting entrepreneurs cannot dedicate 100% of their time and energy to their new business. The time they can dedicate to it may be less efficient. After working all day at another job, a person may feel tired or burned out, so it is difficult to change gears and press forward with full productivity.

Table 3. Bootstrapping Advantages and Disadvantages

| Advantages | Disadvantages |

|

No ownership given up Forces creative solutions Keeping costs low fuels growth |

Slow to start Less glamorous Owner must make personal sacrifices |

Besides the exhausting time investment, moonlighting can exact tolls on personal relationships. This strategy is easiest when an entrepreneur is in a life stage with few commitments. It may have an adverse effect on friendships, but in other life stages, this impact can be more significant. For example, it can detract from relationships with a partner/spouse or children, in both a decrease in focus/investment in these relationships and day-to-day challenges in worklife balance and household management for all affected. At some point, to attract serious investors, a founder will have commit to the project full-time.

Other bootstrapping strategies include negotiating the terms for payments on expenses. When businesses sell to other businesses, the vendor allows the customer to buy on credit. This means that the buyer does not have to pay at the time of purchase. Although retail customers are required to pay at the register during checkout, purchases between businesses can work on different terms, sometimes extended up to 30, 60, or 90 days. This extra time to pay for purchases can be a real advantage for businesses. When a business buys inventory on credit, it can begin selling it before it has even paid for it. For example, a clothing retailer could sell its product in stores or online and receive cash before it had to pay its vendors. Unfortunately, when a business’s cash becomes tight, an ethical dilemma can arise. When a business has more bills to pay than money to pay them with, the owner will need to make tough decisions. Ultimately, when vendors will no longer sell to you on credit, or even at all. When a company can no longer buy inventory to sell to customers, it will not be long until it is out of business. An ethical entrepreneur will alert to this concern and resolve it with aboveboard business decisions.

How Bootstrapping Helps

Although bootstrapping can be painful in the early years of a business, it yields significant benefits for the business owner in the future. One of the most valued benefits of bootstrapping a business is the fact that the founder can maintain control of the company and typically keep 100% ownership. Although it’s easy to give up ownership in an idea because ideas come freely and don’t require financial sacrifice, entrepreneurs who accept an equity financing opportunity and give up a significant portion of ownership of the business may not realize the potential detrimental outcomes. What seems glamorous on Shark Tank may cost a business owner more control than desired. Once you give up any amount of equity in a business, it can be difficult or expensive to get it back. Once the deal is accepted, the investor is entitled to that percentage of the profit every year the company is in business, even if that person never lifts a finger to support the enterprise. Entrepreneurs usually make those financing deals because of the benefits of the money and access to the investor’s contacts. It is unlikely that Mark Cuban is going to roll up his sleeves in your food truck when things get tough. If you can avoid outside financing, you will maintain complete control and full ownership of the business and weigh this benefit in your financing decisions.

Another benefit of bootstrapping is avoiding taking on debt. Whether it is credit cards or personal loans, repayment of debt can take a serious toll on any business and can be especially burdensome for new businesses. Considering that some of the debt financing sources available to entrepreneurs can bear higher-than-average interest rates, digging yourself out from underneath this financial burden is no simple task. Also, delaying outside investments allows your business to grow not only in revenue and profit but also in market value. When potential investors come along, they will consider a higher contribution for a smaller percentage in the business.

Link to Learning

One of the most common forms of debt financing is simply a credit card. Although it may seem wise to charge many of the up-front expenses and simply pay the card’s minimum monthly payment, this can be a treacherous road to go down. Try the credit card calculator to calculate how long it takes to pay off a credit using only the minimum payment. It may shock you. Try a few different amounts: $1,000; $5,000; and $10,000.

One of the most common forms of debt financing is simply a credit card. Although it may seem wise to charge many of the up-front expenses and simply pay the card’s minimum monthly payment, this can be a treacherous road to go down. Try the credit card calculator to calculate how long it takes to pay off a credit using only the minimum payment. It may shock you. Try a few different amounts: $1,000; $5,000; and $10,000.

Personal Finances

Adapted from Fundamentals of Business: Canadian Edition by Pamplin College of Business and Virginia Tech Libraries is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

SOURCE: Suzy Hazelwood.

Learning Objectives

- Describe strategies to minimize and manage debt.

- Explain how to manage monthly income and expenses.

- Define personal finances and financial planning.

- Explain the financial planning life cycle.

- Discuss the advantages of a college education in meeting short-term and long-term financial goals.

- Explain compound interest and the time value of money.

- Discuss the value of getting an early start on your plans for saving.

Show What You Know

An interactive or media element has been excluded from this version of the text. You can view it online here: Link.

An interactive or media element has been excluded from this version of the text. You can view it online here: Link.

The World of Personal Credit

SOURCE: Pixabay.

Do you sometimes wonder where your money goes? Do you worry about how you will pay off your student loans? Would you like to buy a new car or even a home someday and you are not sure where you will get the money? If these questions seem familiar to you, you could benefit from help in managing your personal finances, which this chapter will seek to provide.

Let us say that you are 28 and single. You have a good education, good job, and you are making $60K working with a local accounting firm with a $6,000 retirement savings account, but you carry three credit cards. Your plan is to buy a condo in two or three years and take your dream trip to the world’s hottest surfing spots within five years. The only big worry is your $70,000 in student loan debt, car loan, and credit card debt. Even though you have been gainfully employed for six years now, you could not make a dent in that $70,000. You can afford the necessities of life and then some, but you have occasionally wondered if you are ever going to have enough income to put something toward that debt.191

You are not alone! The average student in Canada will graduate in 2018 having accumulated over $27,000 in student debt. But this is not the only financial problem in Canada. Canadian household debt has reached a record high of over $2.08 trillion as of September 2017, that is $1.68 of debt for every $1 of income.

The Organization for Economic Cooperation and Development began measuring the financial literacy of its OECD countries using a 5-question survey. Take the survey!

The Organization for Economic Cooperation and Development began measuring the financial literacy of its OECD countries using a 5-question survey. Take the survey!

Personal financial literacy is more important than ever in Canada. As a country we need to improve our financial literacy. The Bank for International Settlements, an “international watchdog” regarding country economic risk, has warned that Canada’s banking system is at risk because of the rising collective household debt level. In the coming chapter you will learn the basics of personal financial literacy.

Time is Money

You must choose a career at an early-stage in your financial lifecycle and need to start financial planning early. For instance, it is your 18th birthday, and you take possession of $10,000 that your grandparents put in trust for you. You could spend it or cover the cost of flight training for a private pilot’s license (something you believed was unattainable right away). Your grandparent suggests that you put it into a savings account to grow your $10,000 through interest. Interest is the charge for the privilege of borrowing money, typically expressed as an annual percentage rate, or is the payment made to you from the investing institution on top of the principal amount you invested of $10,000. If you just wait until you finish college, and if you can find a savings plan that pays 5% interest, you will have the $10,000 plus about another $2,000 for something else or to invest.

The total amount you will have, $12,000, piques your interest. If that $10,000 could turn itself into $12,000 after sitting around for four years, what would it be worth if you held on to it until you retired at age 65? A quick trip to the Internet to find a compound interest calculator informs you that, 47 years later, your $10,000 will have grown to $104,345 (assuming a 5% interest rate). That is not enough to retire on, but it would be a good start. What if that four years in college had paid off the way you planned, so that once you get a good job, you can add, say, another $10,000 to your retirement savings account every year until age 65? At that rate, you will have amassed a nice little nest egg of slightly more than $1.6 million.

Compound Interest

In your efforts to appreciate the potential of your $10,000 to multiply itself, you have acquainted yourself with two of the most important concepts in finance. As we have already showed, one is the principle of compound interest, which refers to the effect of earning interest on your interest.

For example, that you take your grandparent’s advice and invest your $10,000 (your principal) in a savings account at an annual interest rate of 5%. Over the course of the first year, your investment will earn $500 in interest and grow to $10,500. If you now reinvest the entire $10,500 at the same 5% annual rate, you will earn another $525 in interest, giving you a total investment at the end-of-year 2 of $11,025. That is how you can end up with $81,496.67 at age 65.

Video 1. Khan Academy: Compound Interest Introduction

Time Value of Money

You have also encountered the principle of the time value of money, the principle whereby a dollar received in the present is worth more than a dollar received in the future. There is one thing that we have stressed throughout this chapter so far, it is the fact that most people prefer to consume now rather than in the future. You likely borrow money from me because you cannot buy something that you want at the present time. By lending to you, I must forego my opportunity to purchase something I want at the present time, which will only occur if I can get some compensation for making that sacrifice (charging you interest). You are going to pay the interest because you need the money to buy what you want now, leading to an understanding on how much interest should we agree on? In theory, it could be just enough to cover the cost of my lost opportunity, but there are, of course, other factors. Inflation, which is the general increase in prices of goods and services and the corresponding decrease in the purchasing power of money, for example, will have eroded the value of my money by the time I get it back from you. In addition, while I would take no risk in loaning money to the Canadian government, I am taking a risk in lending it to you. Our agreed-on rate will reflect such factors.192

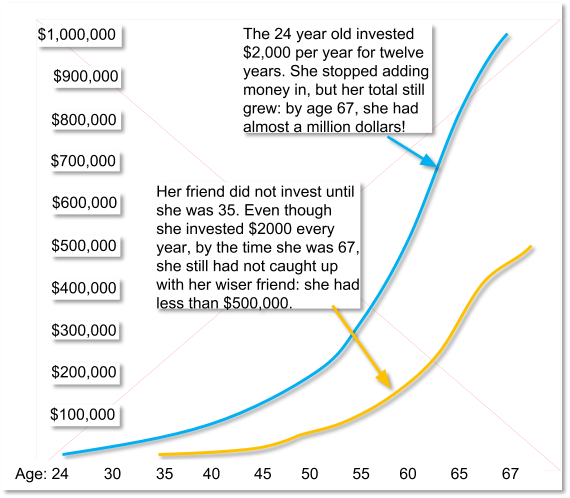

Finally, the time value of money principle also states that a dollar received today earns interest sooner than one received tomorrow. Let us say, for example, that you receive $2,000 in cash gifts when you graduate from college. At age 23, with your college degree in hand, you get a decent job and do not have an immediate need for that $2,000. So, you put it into an account that pays 10% compounded and you add another $2,000 ($167 per month) to your account every year for the next 11 years.193 The blue line in the graph below shows how much your account will earn each year and how much money you will have at certain ages between 24 and 67.

Figure 5. The Power of Compound Interest

As you can see, you would have nearly $52,000 at age 36 and a little more than $196,000 at age 50; at age 67, you would be short of $1 million. The yellow line in the graph shows what you would have if you had not started saving $2,000 a year until you were age 36. As you can also see, you would have a respectable sum at age 37, but less than half of what you would have accumulated by starting at age 23. More important, even to accumulate that much, you would have to add $2,000 per year for 32 years, not just 12.

Table 4. How to save $1,000,000 by Age 67

|

Make your first payment at age: |

And this is what you’ll have to save each month: |

|

20 |

$33 |

|

21 |

$37 |

|

22 |

$42 |

|

23 |

$47 |

|

24 |

$53 |

|

25 |

$60 |

|

26 |

$67 |

|

27 |

$76 |

|

28 |

$85 |

|

30 |

$109 |

|

35 |

$199 |

|

40 |

$366 |

|

50 |

$1,319 |

|

60 |

$6,253 |

Here is another way of looking at the same principle. Suppose that you are 20 years old, do not have $2,000, and do not want to attend college full-time. You are a hard worker and a conscientious saver, and one of your financial goals is to accumulate a $1 million retirement nest egg. If you can put $33 a month into an account that pays 12% interest compounded,194 you can have your $1 million by age 67 – if you start at age 20. As you can see from the figure above, if you wait until you are 21 to save, you will need $37 a month. If you wait until you are 30, save $109 a month, and if you procrastinate until you are 40, the ante goes up to $366 a month.195 Unfortunately in today’s low interest rate environment, finding 10% to 12% return is not likely. These figures illustrate the significant benefit of saving early.

The reason should be obvious: a dollar saved today not only starts earning interest sooner than one saved tomorrow (or ten years from now) but also can ultimately earn a lot more money in the long run. Starting early means in your 20s, early in stage 1 of your financial lifecycle. As one well-known financial advisor puts it, “If you’re in your 20s and you haven’t yet learned how to delay gratification, your life is likely to be a constant financial struggle.”196

Financial Planning

Before we go any further, we need to nail down a couple of key concepts. First, just what, exactly, do we mean by personal finances? Finance itself concerns the flow of money from one place to another, and your personal finances concern your money and what you plan to do with it as it flows in and out of your possession. Essentially personal finance is the application of financial principles to the monetary decisions that you make either for your individual benefit or for that of your family.

Second, as we suggested earlier, monetary decisions work out much more beneficially when they are planned rather than improvised. Our emphasis on financial planning, the ongoing process of managing your personal finances to meet goals that you have set for yourself or your family.

Financial planning requires you to address several questions, some of them relatively simple:

What is my annual income?

How much debt do I have, and what are my monthly payments on that debt?

Others will require some investigation and calculation:

What is the value of my assets?

How can I best budget my annual income?

Still others will require some forethought and forecasting:

How much wealth can I expect to accumulate during my working lifetime?

How much money will I need when I retire?

The Financial Planning Life Cycle

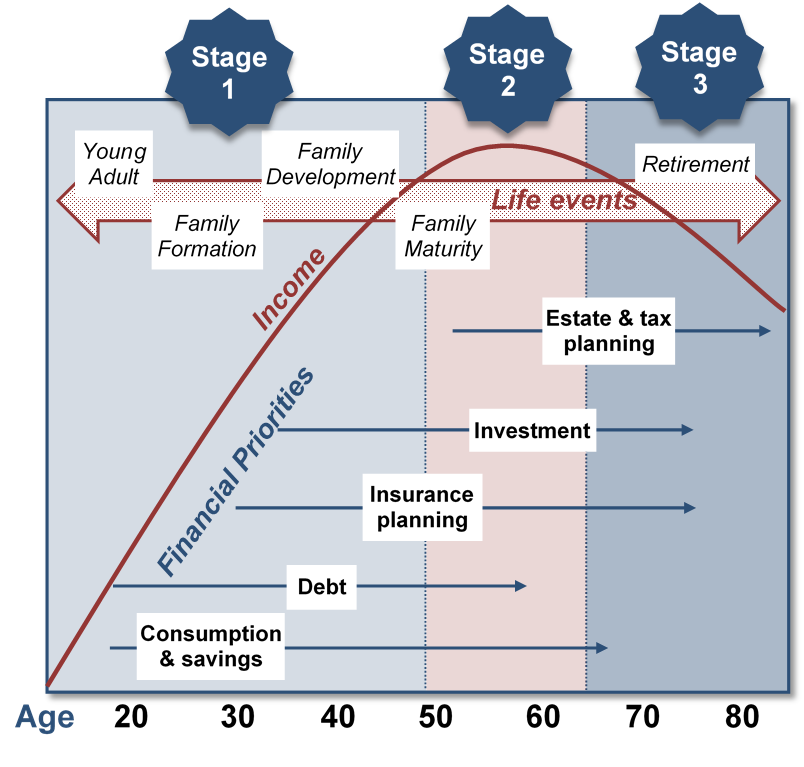

Figure 6. The Financial Life Cycle

Another question that you might ask yourself (and certainly would do if you worked with a professional in financial planning) is: “How will my financial plans change over the course of my life?” The figure above illustrates the financial life cycle of a typical individual, one whose financial outlook and likely outcomes are probably a lot like yours.197 As you can see, our diagram divides this individual’s life into three stages, each of which is characterized by unique life events (such as beginning a family, buying a home, planning an estate, retiring).

At each stage, there are recommended changes in financial planning:

Stage 1 focuses on building wealth.

Stage 2 shifts the focus to preserving and increasing wealth that one has accumulated and continues to accumulate.

Stage 3 turns the focus to living on (and, if possible, continuing to grow) one’s saved wealth after retirement.

At each stage, complications can set in, changes in such conditions as marital or employment status or in the overall economic outlook. Finally, as you can also see, your financial needs will probably peak somewhere in stage 2, at approximately age 55, or 10 years before typical retirement age.

Choosing a Career

Until you are on your own and working, you are probably living on your parents’ wealth right now. In our hypothetical life cycle, financial planning begins in the individual’s early 20s. If that seems like rushing things, consider a basic fact of life: this is the age at which you will choose your career, not only the sort of work you want to do during your prime income-generating years, but also the lifestyle you want to live. What about college? Most readers of this book, of course, have went to college. If you have not yet decided, you need to know that college is an excellent investment of both money and time.

The table below summarizes the most recent, 2015, findings from Statistics Canada.198 A quick review shows that people who graduate from high school can expect to enjoy average annual earnings of just under $50,000, and those who finish college can expect to generate 17% more annual income than high school graduates who did not attend college. With better access to health care, and, studies show, with better dietary and health practices, college graduates will also live longer (so will their children).199

Table 5. Education and Average Income

|

|

Average Income: Canadian Women |

Average Income: Canadian Men |

|

High school diploma |

$43,254 |

$55,774 |

|

College diploma |

$48,599 |

$67,965 |

|

Bachelor’s degree |

$68,342 |

$82,082 |

What about the student loan debt that so many people accumulate? At an average cost of $27,000 (the average amount of debt accumulated by post-secondary students upon graduation) and an average increase in earnings of $263,000 over an average worklife expectancy of 30 years, you would need to invest that $27,000 for 30 years at an average annual rate of return of 8%.200 At that rate of return, be able to pay off your student loans (unless, of course, you cannot practice reasonable financial planning).

Naturally, there are exceptions to these average outcomes. You will find some college graduates stocking shelves at 7-Eleven, and you will find college dropouts running multibillion-dollar enterprises. Microsoft cofounder Bill Gates dropped out of college after two years, as did his founding partner, Paul Allen. Though exceptions to rules (and average outcomes) certainly can be found, they fall far short of disproving them: in entrepreneurship as in most other walks of adult life, the better your education, the more promising your financial future. One expert in the field puts the case for the average person bluntly: educational credentials “are about being employable, becoming a legitimate candidate for a job with a future. They are about climbing out of the dead-end job market.”201

Bringing Down Those Monthly Bills

To practice reasonable financial planning, you must first be able to identify how you can bring down your monthly bills? If you want to take a gradual approach, one financial planner suggests you perform the following “exercises” for one week:202

Keep a written record of everything you spend and total it at week’s end.

Keep all your ATM receipts and count the fees.

Take $100 out of the bank and do not spend a penny more.

Avoid gourmet coffee shops.

SOURCE: Tima.

You will probably be surprised at how much of your money can quickly become somebody else’s money. If, for example, you spend $3 every day for one cup of coffee at a coffee shop, you are laying out nearly $1,100 a year just for coffee. If you use your ATM card at a bank other than your own, you will probably be charged a fee that can be as high as $3. The average person pays more than $60 a year in ATM fees. If you withdraw cash from an ATM twice a week, you could rack up $300 in annual fees.203 Another idea is to eat out as a reward. A sandwich or leftovers from home can be just as tasty and can save you $6 to $10 a day. In 2013, the website DailyWorth asked three women to cut their spending in half. After tracking her spending, one participant discovered she spent $175 eating out in just one week; do that for a year and you would spend over $9,000!204 If you think your cable bill is too high, consider alternatives like Playstation Vue or Sling. Changing channels is different, but the savings can be substantial.

The Latte Factor is trademarked by financial guru David Bach. He and other financial advisors recommend everyone calculate her/his latte factor. He even developed a calculator that shows how much money, over time, you could save by cutting out a small, unnecessary thing from your daily/weekly expenses. Even if you assume a low interest rate e.g., 1%, the savings add up. Find your latte factor!

The Latte Factor is trademarked by financial guru David Bach. He and other financial advisors recommend everyone calculate her/his latte factor. He even developed a calculator that shows how much money, over time, you could save by cutting out a small, unnecessary thing from your daily/weekly expenses. Even if you assume a low interest rate e.g., 1%, the savings add up. Find your latte factor!

You may or may not be among the Canadian consumers who purchased over 3 billion cans, 2 billion bottles and 40 million kegs of beer, in 2016 alone, or purchased one or more of the over 2 billion Tim Hortons coffees sold each year. You may not be one of the 37% of Canadian consumers that regret spending outside of your means.205 Bottom line is if, at age 28, you have a good education and a good job, a $60,000 income, and $70,000 in debt (not an implausible scenario) there is a very good reason to think hard about controlling your debt: your level of indebtedness will be a key factor in your ability (or inability) to reach your longer-term financial goals (i.e. home ownership, dream trip, comfortable retirement).

One of the best ways to manage your money and personal finances is to build a personal budget.

Personal Budget

You will need to have all your information gathered. This includes what you bring in (from employment to student loans) and what goes out for food, entertainment, health and wellness, rent, utilities, etc. Be honest and thorough.

The Government of Canada, through the Financial Agency of Canada, created a tool that provides an in-depth account of your personal finances. Use the Budget Calculator to document your situation. Export your budget as an Excel spreadsheet. You will now be able to make improvements, if appropriate. If your balance is negative, or when your expenses exceed your income, you need to make some choices based on what you learned when you tracked your spending. Ask yourself some tough questions:

What can be eliminated from my expenses?

What can be reduced from my expenses?

In what areas can I be a smarter consumer?

Where does my money seem to get gobbled up?

After you have made some tough choices, turn back to the budget worksheet, and create a new “revised” column. You will want to work toward achieving a positive balance. Should you end up with a surplus or positive balance, you need to make some choices about what to do with the extra money. Perhaps you could put it toward your financial SMARTER goal. Avoid the temptation to spend it. Now let us suppose that while browsing through a magazine in the doctor’s office, you run across a short personal-finances self-help quiz. There are six questions (recreated here):

An interactive or media element has been excluded from this version of the text. You can view it online here: Link.

An interactive or media element has been excluded from this version of the text. You can view it online here: Link.

Personal finances experts tend to utilize the questions on the quiz: if you had 1s or 2s on any of the first three questions, you have a problem with splurging; if questions from four through six got 1s or 2s, your monthly bills are too high for your income.

Building a Good Credit Rating

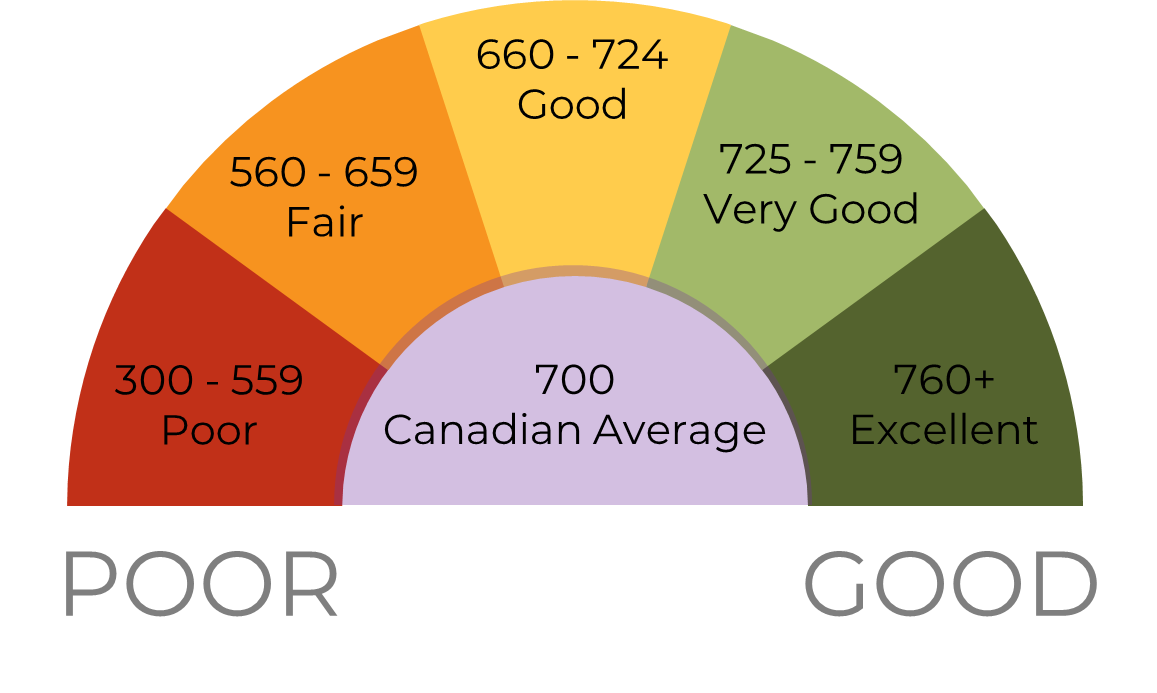

So, you may or may not have a financial problem. According to the quick test you took, do you splurge? Are your bills too high for your income? If you get in over your head and cannot make your loan or rent payments on time, you risk hurting your credit rating, your ability to borrow in the future.

How do potential lenders decide whether you are a good or bad credit risk? If you are a poor credit risk, how does this affect your ability to borrow, or the rate of interest you must pay? Whenever you use credit, those from whom you borrow (retailers, credit card companies, banks) provide information on your debt and payment habits to two national credit bureaus: Equifax, and TransUnion. The credit bureaus use the information to compile a numerical credit score, called a FICO score; it ranges from 300 to 900, with most people falling in the 600–700 range. In compiling the score, the credit bureaus consider five criteria: the primary factors used to calculate your score:

Payment history

Use of available credit

Length of credit history

Number of inquiries

Types of credit

The credit bureaus share their score and other information about your credit history with their subscribers.206

What does this do for you? It depends. If you pay your bills on time and do not borrow too heavily, you will probably have a high FICO score and lenders would like you, probably giving you reasonable interest rates on the loans you requested. But if your FICO score is low, lenders will not likely lend you money (or would lend it to you at high-interest rates). A low FICO score can affect your chances of renting an apartment or landing a particular job. It is very important that you do everything possible to earn and maintain a high credit score.

As a young person, how do you build a credit history that will give you a high FICO score? Based on feedback from several financial experts, Emily Starbuck Gerson and Jeremy Simon of CreditCards.com compiled the following list of ways students can build good credit.207

Become an authorized user on a parent’s account.

Get your own credit card.

Get the right card for you.

Use the credit card for occasional, small purchases.

Avoid big-ticket buys, except in case of emergency.

Pay off your balance each month.

Pay all your other bills on time.

Do not cosign for your friends.

Do not apply for several credit cards at one time.

Use student loans for education expenses only and pay on time.

If you meet the qualifications to get your own credit card, look for a card with a low interest rate and no annual fee.

A Few More Words about Debt

What should you do to turn things around, to get out of debt? According to many experts, you need to take two steps:

Cut up your credit cards and start living on a cash-only basis.

Do whatever you can to bring down your monthly bills.

Although credit cards can be an important way to build a credit rating, many people simply lack the financial discipline to handle them well. If you see yourself in that statement, then moving to a pay-as-you go basis, i.e., cash or debit card only, may be for you. Be honest with yourself; if you cannot handle credit, then do not use it.

Banking

Suppose you want to save or invest; do you know where or how to do so? You probably know that your branch bank can open a savings account for you, but interest rates on such accounts can be unattractive. Investing in individual stocks or bonds can be risky and usually require a level of funds available that most students do not have. In those cases, mutual funds can be quite interesting. A mutual fund is a professionally managed investment program in which shareholders buy into a group of diversified holdings, such as stocks and bonds. Any of the big 5 banks in Canada (RBC, CIBC, BMO, TD Canada, or Scotiabank) offer a range of investment options including indexed funds, which track with well-known indices such as the Toronto Stock Exchange, a.k.a. the TSX. Minimum investment levels in such funds can be within the reach of many students, and the funds accept electronic transfers to make investing more convenient.

You may choose to do your banking with a major bank, or with a local credit union. Most people never notice the differences between credit unions and banks. They offer similar products and services, but they are not the same. The following are some key points which highlight the differences:

Major Banks:

Funds are secure.

Profitability, usually shareholders own a bank and expect financial performance from bank management.

Offer a wide range of competitive and advanced banking products.

Inter-branch banking = convenience,

Credit Unions:

Customers are “members”; deposits are called “shares.”

Credit Unions are non-profit organizations that strive for service over profitability. They are NOT charities; credit unions must make sound financial decisions, collect revenue, pay salaries, and compete with other institutions.

May not have all the banking products as major banks.

Inter-branch banking is limited.

Funds are also secure.

Choose an Institution that is Right for You

An interactive or media element has been excluded from this version of the text. You can view it online here: Link.

An interactive or media element has been excluded from this version of the text. You can view it online here: Link.

As a college or university student, you might be out on your own for the first time. Part of handling your own finances will choose a banking institution or institutions that best suit your needs. Banks are eager to gain new clientele and establish brand loyalty early on. It should come as no surprise that just about every major banking institution in Canada offers student-banking plans.

Now you are ready to plan for your financial future.

Key Takeaways

Credit worthiness is measured by the FICO score (or credit rating) which can range from 300 to 850. The average ranges from 680 to 719.

To maintain a satisfactory score, pay your bills on time, borrow only when necessary, and pay in full whenever you borrow.

81% of financial planners recommend eating out less to reduce your expenses.

Personal finance is the application of financial principles to the monetary decisions that you make.

Financial planning is the ongoing process of managing your personal finances to meet your goals, which vary by stage of life.

Time value of money is the principle that a dollar received in the present is worth more than a dollar received in the future because of its potential to earn interest.

Compound interest refers to the effect of earning interest on your interest. It is a powerful way to accumulate wealth.

Feedback/Errata