Foundations of Business

2 Chapter 2: Success and Failure in Small Businesses

Learning Objectives

- Be able to explain what is meant by business success.

- Be able to describe the different components of business failure.

- Understand that statistics on business failure can be confusing and contradictory.

- Understand that small business failure can be traced to managerial inadequacy, financial issues, and the external environment.

- Understand that small business owners need to be able to formally plan and understand the accounting and finance needs of their firms

What Is a Successful Small Business?

Ask the average person what the purpose of a business is or how he or she would define a successful business, and the most likely response would be “one that makes a profit.” A more sophisticated reply might extend that to “one that makes an acceptable profit now and in the future.” Ask anyone in the finance department of a publicly held firm, and his or her answer would be “one that maximizes shareholder wealth.” The management guru Peter Drucker said that for businesses to succeed, they needed to create customers, while W. E. Deming, the quality guru, advocated that business success required “delighting” customers. No one can argue, specifically, with any of these definitions of small business success, but they miss an important element of the definition of success for the small business owner: to be free and independent.

Many people have studied whether there is any significant difference between the small business owner and the entrepreneur. Some entrepreneurs place more emphasis on growth in their definition of success.[1] However, it is clear that entrepreneurs and small business owners define much of their personal and their firm’s success in the context of providing them with independence. For many small business owners, being in charge of their own life is the prime motivator: a “fervently guarded sense of independence,” and money is seen as a beneficial byproduct.[2] [3] [4] Oftentimes, financial performance is seen as an important measure of success. However, small businesses are reluctant to report their financial information, so this will always be an imperfect and incomplete measure of success. [5] Three types of small business operators can be identified based on what they see as constituting success:

- An artisan whose intrinsic satisfaction comes from performing the business activity

- The entrepreneur who seeks growth

- The owner who seeks independence[6]

When discussing failure rates in small business, there is only one appropriate word: confusion. There are wildly different values, from 90 percent to 1 percent, with a wide range of values in between.[7] Obviously, there is a problem with these results, or some factor is missing. One factor that would explain this discrepancy is the different definitions of the term failure. A second factor is that of timeline. When will a firm fail after it starts operation?

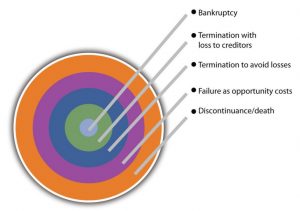

The term failure can have several meanings.[8] Small-business failure is often measured by the cessation of a firm’s operation, but this can be brought about by several things:

- An owner can die or simply choose to discontinue operations.

- The owner may recognize that the business is not generating sufficient return to warrant the effort that is being put into it. This is sometimes referred to as the failure of opportunity cost.

- A firm that is losing money may be terminated to avoid losses to its creditors.

- There can be losses to creditors that bring about cessations of the firm’s operations

- The firm can experience bankruptcy. Bankruptcy is probably what most people think of when they hear the term business failure. However, the evidence indicates that bankruptcies constitute only a minor reason for failure.

Failure can therefore be thought of in terms of a cascading series of outcomes (see Figure 2.1 “Types of Business Failures”). There are even times when small business owners involved in a closure consider the firm successful at its closing.[9] Then there is the complication of considering the industry of the small business when examining failure and bankruptcy. The rates of failure can vary considerably across different industries; in the fourth quarter of 2009, the failure rates for service firms were half that of transportation firms.[10]

The second issue associated with small business failure is a consideration of the time horizon. Again, there are wildly different viewpoints. The Dan River Small Business Development Center presented data that indicated that 95 percent of small businesses fail within five years.[11] Dun and Bradstreet reported that companies with fewer than twenty employees have only a 37 percent chance of surviving four years, but only 10 percent will go bankrupt.[12] The US Bureau of Labor Statistics indicated that 66 percent of new establishments survive for two years, and that number drops to 44 percent two years later.[13] It appears that the longer you survive, the higher the probability of your continued existence. This makes sense, but it is no guarantee. Any business can fail after many years of success.

Why Do Small Businesses Fail?

There is no more puzzling or better studied issue in the field of small business than what causes them to fail. Given the critical role of small businesses in the US economy, the economic consequences of failure can be significant. Yet there is no definitive answer to the question.

Three broad categories of causes of failure have been identified: managerial inadequacy, financial inadequacy, and external factors. The first cause,managerial inadequacy, is the most frequently mentioned reason for firm failure.[14] Unfortunately, it is an all-inclusive explanation, much like explaining that all plane crashes are due to pilot failure. Over thirty years ago, it was observed that “while everyone agrees that bad management is the prime cause of failure, no one agrees what ‘bad management’ means nor how it can be recognized except that the company has collapsed—then everyone agrees that how badly managed it was.”[15] This observation remains true today.

The second most common explanation cites financial inadequacy, or a lack of financial strength in a firm. A third set of explanations center on environmental or external factors, such as a significant decline in the economy. Because it is important that small firms succeed, not fail, each factor will be discussed in detail. However, these factors are not independent elements distinct from each other. A declining economy will depress a firm’s sales, which negatively affects a firm’s cash flow. An owner who lacks the knowledge and experience to manage this cash flow problem will see his or her firm fail.

Managerial inadequacy is generally perceived as the major cause of small business failure. Unfortunately, this term encompasses a very broad set of issues. It has been estimated that two thirds of small business failures are due to the incompetence of the owner-manager.[16] The identified problems cover behavioral issues, a lack of business skills, a lack of specific technical skills, and marketing myopia. Specifying every limitation of these owners would be prohibitive. However, some limitations are mentioned with remarkable consistency. Having poor communication skills, with employees and/or customers, appears to be a marker for failure.[17] The inability to listen to criticism or divergent views is a marker for failure, as is the inability to be flexible in one’s thinking.[18]

Ask many small business owners where their strategic plans exist, and they may point to their foreheads. The failure to conduct formal planning may be the most frequently mentioned item with respect to small business failure. Given the relative lack of resources, it is not surprising that small firms tend to opt for intuitive approaches to planning.[19][20] Formal approaches to planning are seen as a waste of time,[21] or they are seen as too theoretical.[22] The end result is that many small business owners fail to conduct formal strategic planning in a meaningful way.[23][24] In fact, many fail to conduct any planning;[25][26] others may fail to conduct operational planning, such as marketing strategies.[27] The evidence appears to clearly indicate that a small firm that wishes to be successful needs to not only develop an initial strategic plan but also conduct an ongoing process of strategic renewal through planning.

Many managers do not have the ability to correctly select staff or manage them.[28] Other managerial failings appear to be in limitations in the functional area of marketing. Failing firms tend to ignore the changing demands of their customers, something that can have devastating effects.[29] The failure to understand what customers value and being able to adapt to changing customer needs often leads to business failure.[30]

The second major cause of small business failure is finance. Financial problems fall into three categories: start-up, cash flow, and financial management. When a firm begins operation (startup), it will require capital. Unfortunately, many small business owners initially underestimate the amount of capital that should be available for operations.[31] This may explain why most small firms that fail do so within the first few years of their creation. The failure to start with sufficient capital can be attributed to the inability of the owner to acquire the needed capital. It can also be due to the owner’s failure to sufficiently plan for his or her capital needs. Here we see the possible interactions among the major causes of firm failure. Cash-flow management has been identified as a prime cause for failure.[32][33] Good cash-flow management is essential for the survival of any firm, but small firms, in particular, must pay close attention to this process.

Small businesses must develop and maintain effective financial controls, such as credit controls.[34] For very small businesses, this translates into having an owner who has at least a fundamental familiarity with accounting and finance.[35] In addition, the small firm will need either an in-house or an outsourced accountant.[36] Unfortunately, many owners fail to fully use their accountants’ advice to manage their businesses.[37]

The last major factor identified with the failure of small businesses is the external environment. There is a potentially infinite list of causes, but the economic environment tends to be most prominent. Here again, however, confusing appears to describe the list. Some argue that economic conditions contribute to between 30 percent and 50 percent of small business failures, in direct contradiction to the belief that managerial incompetence is the major cause.[38] Two economic measures appear to affect failure rates: interest rates, which appear to be tied to bankruptcies, and the unemployment rate, which appears to be tied to discontinuance.[39] The potential impact of these external economic variables might be that small business owners need to be either planners to cover potential contingencies or lucky.

Even given the confusing and sometimes conflicting results with respect to failure in small businesses, some common themes can be identified. The reasons for failure fall into three broad categories: managerial inadequacy, finance, and environmental. They, in turn, have some consistently mentioned factors (see Table 2.1 “Reasons for Small Business Failure”). These factors should be viewed as warning signs—danger areas that need to be avoided if you wish to survive. Although small business owners cannot directly affect environmental conditions, they can recognize the potential problems that they might bring. This text will provide guidance on how the small business owner can minimize these threats through proactive leadership.

Table 2.1 Reasons for Small Business Failure

| Managerial Inadequacy | Financial Inadequacy | External Factors |

|

|

|

Ultimately, business failure will be a company-specific combination of factors. Monitor101, a company that developed an Internet information monitoring product for institutional investors in 2005, failed badly. One of the cofounders identified the following seven mistakes that were made, most of which can be linked to managerial inadequacy:[40]

- The lack of a single “the buck stops here” leader until too late in the game

- No separation between the technology organization and the product organization

- Too much public relations, too early

- Too much money

- Not close enough to the customer

- Slowness to adapt to market reality

- Disagreement on strategy within the company and with the board

“Entrepreneurs Turn Business Failure into Success” Bloomberg Businessweek’s 2008 cover story highlights owners who turn business failure into success. [41]

Key Takeaways

- There is no universal definition for small business success. However, many small business owners see success as their own independence.

- The failure rates for small businesses are wide ranging. There is no consensus.

- Three broad categories of factors are thought to contribute to small business failure: managerial inadequacy, financial inadequacy, and external forces, most notably the economic environment.

Exercises

- Starting a business can be a daunting task. It can be made even more daunting if the type of business you choose is particularly risky. Go to: www.forbes.com/2007/01/18/fairisaac-nordstromverizon-ent-fincx_mf_0118risky_slide.html?thisSpeed=undefined; where the ten riskiest businesses are identified. Select any two of these businesses and address why you think they are risky

- Amy Knaup is the author of a 2005 study “Survival and Longevity in the Business Employment Dynamics Data” ( seewww.bls.gov/opub/mlr/2005/05/ressum.pdf ). The article points to different survival rates for ten different industries. Discuss why there are significant differences in the survival rates among these industries.

- William Dunkelberg and A. C. Cooper. “Entrepreneurial Typologies: An Empirical Study,” Frontiers of Entrepreneurial Research, ed. K. H. Vesper (Wellesley, MA: Babson College, Centre for Entrepreneurial Studies, 1982), 1–15. ↵

- “Report on the Commission or Enquiry on Small Firms,” Bolton Report, vol. 339 (London: HMSO, February 1973), 156–73. ↵

- Paul Burns and Christopher Dewhurst, Small Business and Entrepreneurship, 2nd ed. (Basingstoke, UK: Macmillan, 1996), 17. ↵

- Graham Beaver, Business, Entrepreneurship and Enterprise Development(Englewood Cliffs, NJ: Prentice Hall, 2002), 33. ↵

- Terry L. Besser, “Community Involvement and the Perception of Success Among Small Business Operators in Small Towns,” Journal of Small Business Management 37, no 4 (1999): 16. ↵

- M. K. J. Stanworth and J. Curran, “Growth and the Small Firm: An Alternative View,” Journal of Management Studies 13, no. 2 (1976): 95–111. ↵

- Roger Dickinson, “Business Failure Rate,” American Journal of Small Business 6, no. 2 (1981): 17–25. ↵

- A. B. Cochran, “Small Business Failure Rates: A Review of the Literature,”Journal of Small Business Management 19, no. 4, (1981): 50–59. ↵

- Don Bradley and Chris Cowdery, “Small Business: Causes of Bankruptcy,” July 26, 2004, accessed October 7, 2011, www.sbaer.uca.edu/research/asbe/2004_fall/16.pdf. ↵

- “Equifax Study Shows the Ups and Downs of Commercial Credit Trends,”Equifax, 2010, accessed October 7, 2011 www.equifax.com/PR/pdfs/CommercialFactSheetFN3810.pdf ↵

- Don Bradley and Chris Cowdery, “Small Business: Causes of Bankruptcy,” July 26, 2004, accessed October 7, 2011,www.sbaer.uca.edu/research/asbe/2004_fall/16.pdf. ↵

- Don Bradley and Chris Cowdery, “Small Business: Causes of Bankruptcy,” July 26, 2004, accessed October 7, 2011,www.sbaer.uca.edu/research/asbe/2004_fall/16.pdf ↵

- Anita Campbell, “Business Failure Rates Is Highest in First Two Years,” Small Business Trends, July 7, 2005, accessed October 7, 2011,smallbiztrends.com/2005/07/business-failure-rates-highest-in.html ↵

- T. C. Carbone, “The Challenges of Small Business Management,” Management World 9, no. 10 (1980): 36. ↵

- John Argenti, Corporate Collapse: The Causes and Symptoms (New York: McGraw-Hill, 1976), 45. ↵

- Graham Beaver, “Small Business: Success and Failure,” Strategic Change 12, no. 3 (2003): 115–22. ↵

- Sharon Nelton, “Ten Key Threats to Success,” Nation’s Business 80, no. 6 (1992): 18–24. ↵

- Robert N. Steck, “Why New Businesses Fail,” Dun and Bradstreet Reports 33, no. 6 (1985): 34–38. ↵

- G. E. Tibbits, “Small Business Management: A Normative Approach,” in Small Business Perspectives, ed. Peter Gorb, Phillip Dowell, and Peter Wilson (London: Armstrong Publishing, 1981), 105. ↵

- Jim Brown, Business Growth Action Kit (London: Kogan Page, 1995), 26. ↵

- Christopher Orpen, “Strategic Planning, Scanning Activities and the Financial Performance of Small Firms,” Journal of Strategic Change 3, no. 1 (1994): 45–55. ↵

- Sandra Hogarth-Scott, Kathryn Watson, and Nicholas Wilson, “Do Small Business Have to Practice Marketing to Survive and Grow?,” Marketing Intelligence and Planning 14, no. 1 (1995): 6–18. ↵

- Isaiah A. Litvak and Christopher J. Maule, “Entrepreneurial Success or Failure—Ten Years Later,” Business Quarterly 45, no. 4 (1980): 65. ↵

- Hans J. Pleitner, “Strategic Behavior in Small and Medium-Sized Firms: Preliminary Considerations,” Journal of Small Business Management 27, no. 4 (1989): 70–75. ↵

- Richard Monk, “Why Small Businesses Fail,” CMA Management 74, no. 6 (2000): 12. ↵

- Anonymous, “Top-10 Deadly Mistakes for Small Business,” Green Industry Pro19, no. 7 (2007): 58. ↵

- Rubik Atamian and Neal R. VanZante, “Continuing Education: A Vital Ingredient of the ‘Success Plan’ for Business,” Journal of Business and Economic Research 8, no. 3 (2010): 37–42. ↵

- T. Carbone, “Four Common Management Failures—And How to Avoid Them,”Management World 10, no. 8 (1981): 38–39. ↵

- Anonymous, “Top-10 Deadly Mistakes for Small Business,” Green Industry Pro19, no. 7 (2007): 58. ↵

- Rubik Atamian and Neal R. VanZante, “Continuing Education: A Vital Ingredient of the ‘Success Plan’ for Business,” Journal of Business and Economic Research 8, no. 3 (2010): 37–42. ↵

- Howard Upton, “Management Mistakes in a New Business,” National Petroleum News 84, no. 10 (1992): 50. ↵

- Rubik Atamian and Neal R. VanZante, “Continuing Education: A Vital Ingredient of the ‘Success Plan’ for Business,” Journal of Business and Economic Research 8, no. 3 (2010): 37–42. ↵

- Arthur R. DeThomas and William B. Fredenberger, “Accounting Needs of Very Small Business,” The CPA Journal 55, no. 10 (1985): 14–20. ↵

- Roger Brown, “Keeping Control of Your Credit,” Motor Transportation, April 2009, 8. ↵

- Arthur R. DeThomas and William B. Fredenberger, “Accounting Needs of Very Small Business,” The CPA Journal 55, no. 10 (1985): 14–20. ↵

- Hugh M. O’Neill and Jacob Duker, “Survival and Failure in Small Business,”Journal of Small Business Management 24, no. 1 (1986): 30–37. ↵

- Arthur R. DeThomas and William B. Fredenberger, “Accounting Needs of Very Small Business,” The CPA Journal 55, no. 10 (1985): 14–20. ↵

- Jim Everett and John Watson, “Small Business Failures and External Risk Factors,” Small Business Economics 11, no. 4 (1998): 371–90. ↵

- Jim Everett and John Watson, “Small Business Failures and External Risk Factors,” Small Business Economics 11, no. 4 (1998): 371–90. ↵

- Roger Ehrenberg, “Monitor 110: A Post Mortem—Turning Failure into Learning,” Making It!, August 27, 2009, accessed June 1, 2012,http://www.makingittv.com/Small-Business-Entrepreneur-StoryFailure.htm ↵

- http://www.businessweek.com/magazine/content/08_70/s0810040731198.htm ↵